Have you ever seen a GST certificate displayed in a shop or even in a supermarket? This certificate is given by the government and is used as official proof that the business is registered under the GST law in India.

Any business in India must register for GST if its yearly income (turnover) is more than the set limit — Rs. 40 lakh for most states and Rs. 20 lakh for special category states. Some businesses also have to register even if they do not cross this limit, based on government rules. After completing the registration through the GST Login portal, the business must display the GST registration certificate at its workplace.

What is a GST Registration Certificate?

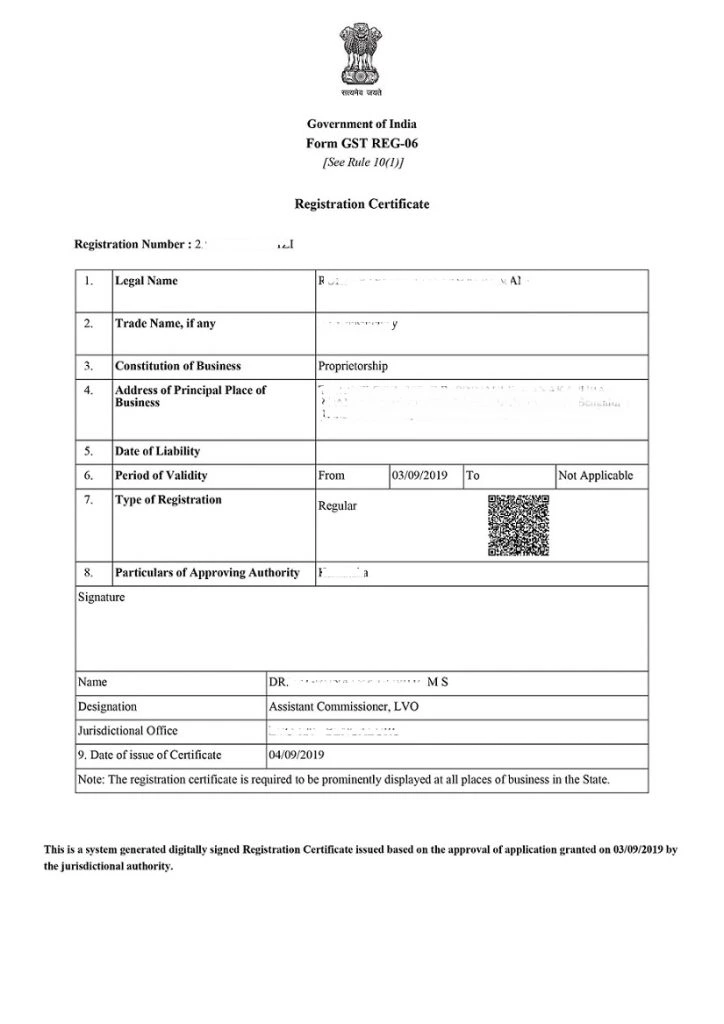

Every taxpayer who registers successfully under GST receives a GST registration certificate in Form GST REG-06. This certificate includes important details like the GST Identification Number (GSTIN) and the main and additional business locations. You can download this certificate only from the GST Portal. The government does not provide any physical (paper) certificate.

Different types of taxpayers receive this certificate, such as:

- Regular taxpayers

- TDS and TCS applicants under GST

- People who must get a Unique Identity Number (UIN) under Section 25(9) of the CGST Act

- Non-resident taxpayers, including those offering OIDAR services

- Taxpayers who shifted from the old tax laws before GST was introduced

Step-by-Step Guide to Download GST Certificate from GST Portal

If you are already registered as a taxpayer under GST, you can download your GST Registration Certificate (Form GST REG-06) from the GST portal. It is available only online on the GST portal. The government does not provide a printed or physical certificate.

Below is the step-by-step process to download the GST Registration Certificate in Form GST REG-06

1. Log in to the GST Portal.

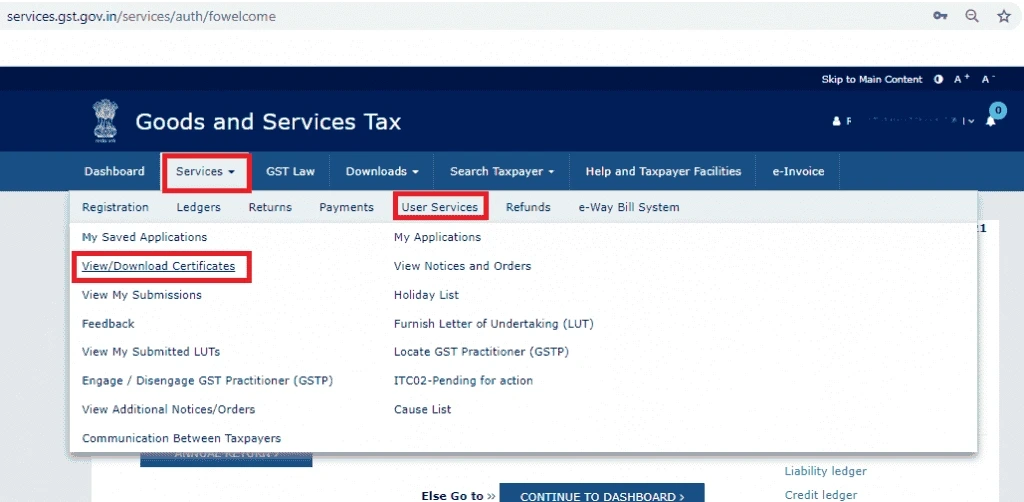

2. Go to ‘Services’ > ‘User Services’ > ‘View/ Download Certificate.

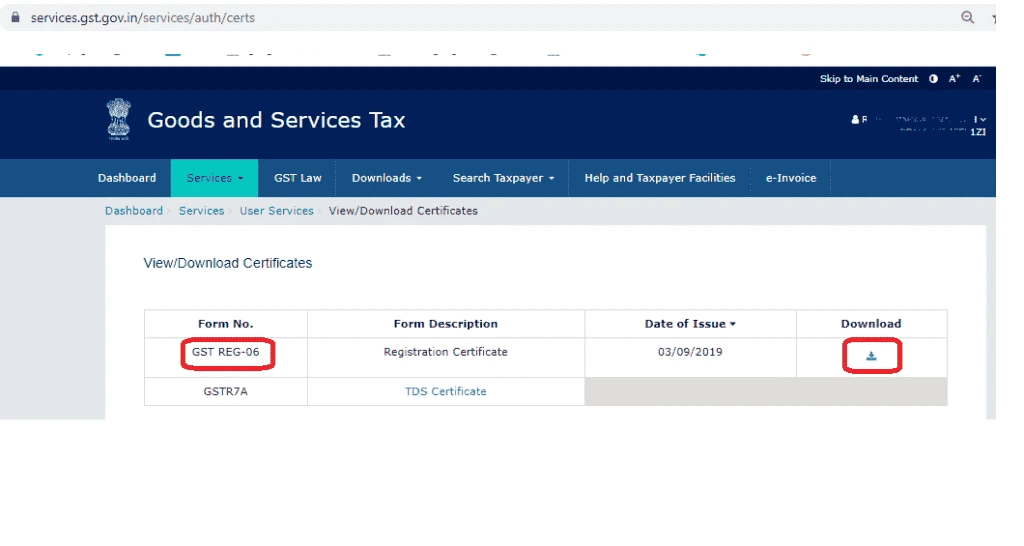

3. Click on the ‘Download’ icon.

4. Open the downloaded PDF document and take a printout.

5. Display the printed certificate prominently at all your places of business in the State or UT.

Team Clear makes getting your GST registration certificate quick and easy. Check out our GST registration service by clicking this link.

Also Reas: PM Kisan Tractor Yojana

Validity Period of the GST Registration Certificate

- The GST registration certificate starts from the date a person becomes required to register for GST, if they apply within 30 days of that date. If they apply after 30 days, the certificate is valid from the date it is issued, according to CGST Rules 9(1), 9(3), and 9(5).

- If there is a delay caused by the officer under Rule 9(5), the officer must send the signed certificate within three working days after the allowed period

- For regular taxpayers, the certificate does not expire. It remains valid as long as the GST registration is active and has not been cancelled or surrendered.

- For casual taxable persons, GST registration is valid for a maximum of 90 days. After this, the certificate becomes invalid. However, the taxpayer can extend or renew the registration before it expires.

Contents of a GST Registration Certificate

The GST registration certificate has a main certificate and two annexures, called Annexure-A and Annexure-B. Here is what each part contains:

The main GST Registration Certificate includes:

GSTIN (GST Identification Number) of the taxpayer

Trade Name and Legal Name

Type of Business (for example, Partnership, Company, Proprietorship, Trust, etc.)

Address of the main business location

Date when GST liability started

Period of validity: Usually, the certificate shows a “From date.” Regular taxpayers do not have a “To date.” Only casual or non-resident taxpayers have a “To date.”

Details in Annexure-A include:

GSTIN (Goods and Services Tax Identification Number)

Legal Name of the business

Trade Name (if available)

Extra Places of Business

Details in Annexure-B include:

GSTIN

Legal Name

Trade Name (if applicable)

Information about the owner, partners, Karta, managing director, whole-time director, or board of trustees. This includes their photo, name, designation or position, and the state they live in.

How to Make Changes to Your GST Registration?

To change details in your GST registration certificate, first check if the detail is a core field or a non-core field. Then, log in to the GST portal and go to Services > Registration > Amendment of Registration-Core – Core Fields or Amendment of Registration – Non-Core Fields, depending on what you want to change. You can add, delete, or update the information. Upload any required documents. Finally, save the changes and complete the verification using an authorised signatory with DSC, e-Signature, or EVC.

What changes in GST Registration can be made?

In GST registration, some details can be changed, but there are two types of fields: core and non-core.

Core fields are important details that need approval from a tax officer before they can be updated. These include:

- Business name (legal name), if the PAN hasn’t changed

- Main and additional business locations (except if the State changes)

- Adding or removing stakeholders like promoters, partners, Karta, Managing Committee members, or the CEO.

Non-core fields are less critical and can be updated without verification. These include:

- Bank details

- General business information

- Description of goods and services।

- State-specific information (as long as the State itself doesn’t change)

- Authorised signatories or representatives

- Changes to existing stakeholders’ details (promoters, partners, Karta)

- Minor updates to principal and additional business locations

Downloading GST Certificate: Common Problems and How to Solve Them

Sometimes, taxpayers may face problems while trying to access their GST certificate on the GST portal. Here are some common issues and how to fix them:

- Forgotten login details – If you forget your username or password, go to the login page and click on ‘Forgot Username’ or ‘Forgot Password’. Follow the steps to verify your identity and recover your username or reset your password. After this, you can log in and download your GST certificate.

- Wrong GSTIN – Sometimes, people enter the wrong GSTIN by mistake. Make sure you enter the correct GSTIN to successfully download your GST registration certificate.

- Technical problems – The portal may sometimes face technical issues or downtime. In such cases, try again after some time or contact the GST helpdesk for support.

GST Certificate for Different Types of Businesses

Most of the information on a GST certificate is the same for all taxpayers. But some details may differ depending on the type of taxpayer. Here’s a breakdown:

1. Regular or normal taxpayers

The GST certificate for regular taxpayers shows basic registration details. It allows them to claim input tax credit.

2. Composition of taxable persons

Small businesses registered under the composition scheme must keep their GST certificate and display it clearly. It shows that they are composition taxpayers, do not collect GST from customers, and cannot claim input tax credit.

3. Casual taxable persons

If a taxpayer wants to make taxable supplies occasionally or temporarily, such as at exhibitions, they can register as a casual taxable person. They also need a GST certificate, which can be obtained from the GST portal.

4. Non-resident taxable persons

Non-resident businesses operating temporarily in India must register under GST. They need to display their GSTIN at the office and keep the GST certificate, which includes their place of business.

Frequently Asked Questions (FAQs)

To download your GST certificate, log in to the GST portal, go to “Services” → “Certificates” → “View/Download,” select your registration, and download the PDF.

You can get a GST number by applying online on the GST portal, submitting business details, uploading documents, completing verification, and receiving the GSTIN after approval.

Log in to the GST portal, go to Services > User Services > View/Download Certificates, select Registration Certificate, and click Download to save your GST certificate.

New GST rates become applicable from the date notified in the Official Gazette after the GST Council approves the changes in its meeting and issues a notification.

You can apply for a GST number online on the GST portal by creating an account, submitting business details and documents, verifying OTP, and completing the application submission.